summit county utah sales tax

County County Public Transit. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

The US average is 73.

. Beer Alcohol Licensing. The Utah state sales tax rate is currently. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800.

5 State Sales tax is 485. Conference Room Policy PDF Flood Plain Maps. Income and Salaries for Summit County - The average income of a Summit County resident is 45461 a year.

Summit County Home Page. You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables. Estimated Combined Tax Rate 715 Estimated County Tax Rate 155 Estimated City Tax Rate 000 Estimated Special Tax Rate 075 and Vendor Discount 00131.

Bids Request for Proposals. Report and pay this tax using form TC-62F Restaurant Tax Return. The US average is 46.

Automating sales tax compliance can help your business keep compliant with. The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. The 2018 United States Supreme Court decision in South Dakota v.

Sales Tax and Use Tax Rate of Zip Code 84017 is located in Coalville City Summit County Utah State. Access county bids and request for proposals. The Summit County Council established the Restaurant Tax Advisory Committee to investigate advise and recommend.

- The Income Tax Rate for Summit County is 50. The US average is 28555 a. Lowest sales tax 61 Highest sales tax.

Utah has a 485 statewide sales tax rate but also has 208 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2053 on top of the state tax. The entire combined rate is due on all taxable transactions in that tax jurisdiction. Complete the online building application.

The restaurant tax applies to all food sales both prepared food and grocery food. Access Utah sales and use tax rates on the Utah State Tax Commissions website. Manage Summit County Funds.

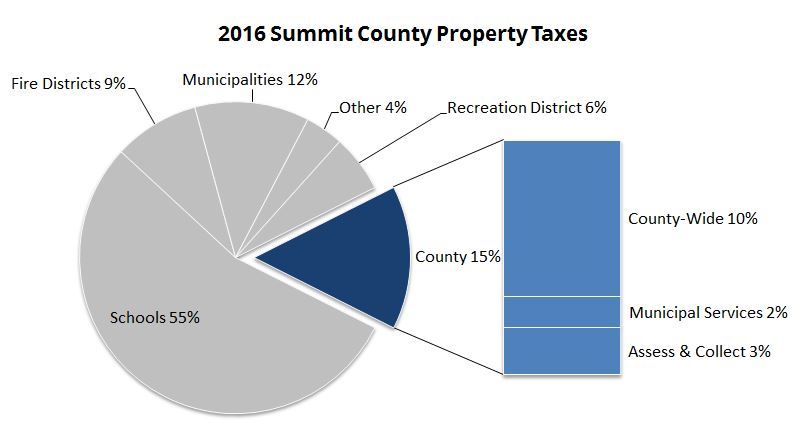

The Summit County Treasurer is responsible for the collection distribution and reconciliation of property taxes levied by all of the taxing entities in Summit County. Ad Automate Standardize Taxability on Sales and Purchase Transactions. See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax.

- Tax Rates can have a big impact when Comparing Cost of Living. 3 rows Summit County UT Sales Tax Rate The current total local sales tax rate in Summit County. 6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and.

Integrate Vertex seamlessly to the systems you already use. Has impacted many state nexus laws and sales tax collection requirements. Tax Rates for Summit County - The Sales Tax Rate for Summit County is 78.

The primary purpose of the Restaurant Tax Grant is to promote tourism as set out by the Utah State Statute and the County Council. County Jan-18 11917001 24238463 3737024 75292525 13963108 55689080 30979593. 2022 List of Utah Local Sales Tax Rates.

Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Summit County Utah Recorder-4353363238 Assessor-4353363211.

The Summit County sales tax rate is. The Summit County 2021 Tax Sale will be held on. To review the rules in Utah visit our state-by-state guide.

The countys 2021 sales tax collections were up about 23 compared to 2019 and up about 35 compared to 2020. Sales is under Consumption taxes. Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit.

Utah Sales. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06. A county-wide sales tax rate of 155 is.

8 rows The Summit County Sales Tax is 155. The entity that had the second highest swing was Summit County government. Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit.

State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes.

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Utah Summit County Parcels Arcgis Hub

Summit County Fair Posts Facebook

News Flash Summit County Ut Civicengage

News Flash Summit County Ut Civicengage

How Healthy Is Summit County Utah Us News Healthiest Communities

News Flash Summit County Ut Civicengage